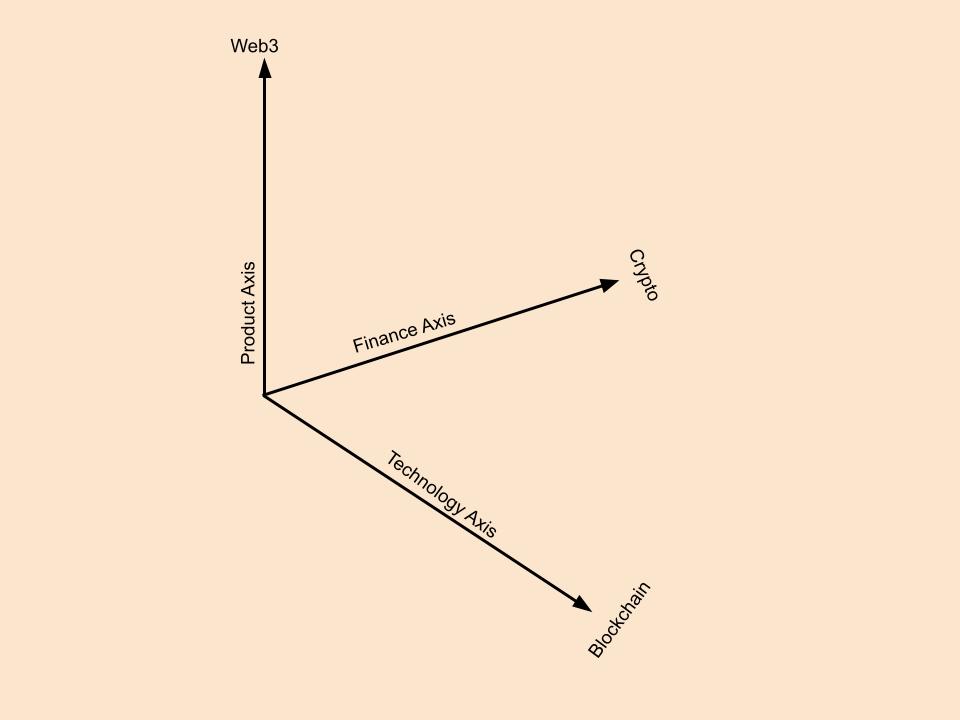

Much to the chagrin of pedants, people use the terms Crypto, Blockchain, and Web3 interchangeably. This makes reasoning about this space difficult and sometimes hilarious. To better understand this space, I propose we break things down along three axes, namely Tech, Finance, and Product.

Now instead of Crypto, Blockchain, and Web3 being vaguely related marketing terms, they take on a much more specific meaning, as progress along our three axes.

Why these three?

For the simple reason, that progress along one axis is independent of progress along another. Each axis has its way of doing things, with different priorities. Let’s dig a little deeper into this framework

The Technology axis

Blockchain tech has fundamentally different priorities on Scale, Cost Structures, and openness from legacy tech. Blockchain tech, grew up thinking an adversarial environment is a default because it was mainly dealing with people’s digital valuables. So openness comes from not trusting another node, checking and needing consensus comes from valuing decentralization. These priorities, while great for the environment they got started in, don’t lend themselves well to servicing billions of people.

This is a platform shift as big as the move to cloud computing.

A few core differences

- Instead of a server, the core unit here is a node.

- The shared global state is not free to update.

- Wallet addresses are primary objects in these namespaces.

Progress along core blockchain tech is the least mentioned and most misunderstood. It has to deal with consensus between nodes, changes to the global state and their finality, and the way information is transferred between nodes.

This is also where most of the compromise between ease of use and the blockchain ethos happens. For example, who defines what a node or a miner has to do? Where do you deploy a smart contract? Do you have to broadcast a transaction to everyone? Can you create OFAC-compliant transaction pools?

The word “blockchain” itself is a suitcase word and means many things to many people. But it makes sense to have core blockchain tech as an axis.

The Finance axis

The finance axis sees the most amount of progress. Because, there is a direct monetary benefit, analogies to legacy finance and lethargic regulators. Finance ( or at least currencies, however bad that framing was ) is how Bitcoin got started and most of this space is people trying to make their forms of value (money, equity, structured instruments) from the ground up without the baggage of a regulator or consumer protection.

The core ethos of this axis is “minimize the cost of capital, maximize the rate of return, not illegally.”

Non-scammy products, along this axis, come in one of the following flavors

- Take an existing financial product, and use the blockchain to create a lower-cost, global and deterministic version of it. This is the Programmable Finance thesis.

- New products that use novel features of this space.

- Businesses that service the financial needs of crypto-specific businesses.

This is also where most, if not all of the scams happen. Why? Because projects here use the shiny new blockchain word to try and evade responsibility or engage in predatory practices because the rules haven’t been enforced yet.

The Product axis

The product axis is where there has been the least progress. Web3 products are confusing to users right now, who come in expecting something from an app that provides something else. Adoption here is measured in number of people using your product instead of how many assets you have accumulated.

Some core differences from legacy products include

- Replacing Email or digital identity with Public Addresses

- Making the core business process open-access

- Emphasis on local first architecture

- Minimizing what is made public on the chain

This is an incredible open space of problems just waiting for solutions. Progress along this axis is what I am excited to track

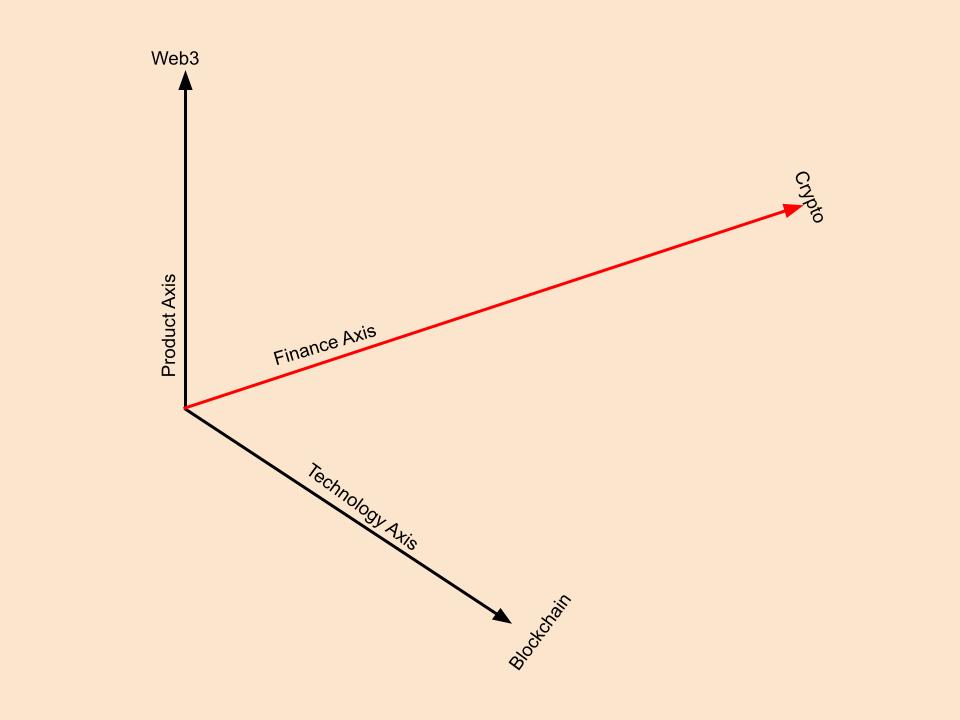

How are things at the moment?

You can securitize, lend, fractionalize and hypothecate your monkey picture ad-nauseam, but still can’t directly message a public address. Infrastructure is built with a financial transaction in mind. There are environments that aren’t purely adversarial. This space would do well to build for those environments.

A tidal wave of speculation has skewed progress along the finance axis.

What’s missing?

No framework is complete, and an attempt to make a complete one takes too much time. So here are a few things not captured directly by this framework.

Comparing L1s and Cross Chain Apps

This framework is great for comparing blockchain-enabled products. It works less well for comparing Layer 1s (blockchains to blockchains) or apps that straddle multiple chains. For example, would you place an AMM on Polygon and an AMM on Dentacoin in the same place? Where would a cross-chain bridge go? These are subjective questions that have different answers based on what you value. Where do L1s go? The perfectionist in me wants to place each blockchain at the origin of its model.

But good is better than perfect, and decisions are taken on imperfect information.

Value Created vs Captured

Where would you place a lending app with its token vs a lending app without a token, Is that a different place from a lending app with most of its token held by one person? In the absence of a value judgment on how efficiently an application is run or a measure of decentralization, these applications could in theory occupy the same place in this framework.

Decentralization

This framework is also ambiguous in valuing decentralization, precisely because people don’t have a consistent value for decentralization. You could put a decentralized application further along the tech axis because if it was decentralized, it would be solving some unique technical challenges, but that isn’t intuitive.

All models are wrong, but some are useful.

No framework maps 100% to reality, and I’m not saying this one is perfect. This one solves my need to distinguish bullshit from work, financialization from technological improvement, and use case from speculation.

So next time you hear a blockchain pitch or claim, take one moment to break it down along the Tech, Finance, and Product axes and you will have a better conversation.